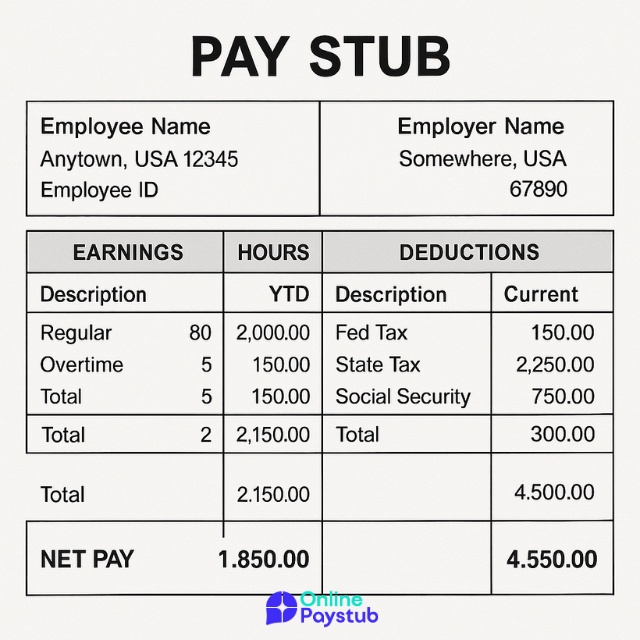

A pay stub is a financial document that outlines an employee's wages and deductions for a specific pay period. Whether you're a freelancer, contractor, or business owner, a pay stub helps verify income and provides transparency in payroll transactions. It often includes details such as gross pay, net pay, tax withholdings, and other relevant deductions.

With Online Pay Stub, generating these documents becomes effortless with no complex software or financial knowledge required.

W2 Form

W2 Form

Payroll

Payroll

Finance

Finance

A pay stub and a paycheck are closely related, but not exactly the same. A paycheck is the actual payment an employee receives for their work either as a physical check or through direct deposit. A pay stub, also known as a wage slip or earnings statement, provides a detailed breakdown of how the payment was calculated. It shows things like gross pay, deductions, net pay, and YTD (year-to-date) earnings.

The requirement to provide pay stubs depends on your location. In many states and regions, employers are legally obligated to issue a pay stub for each pay period, whether digitally or on paper. Even when it's not legally required, offering pay stubs is considered a best practice for employment proof and transparency in payroll processes.

This makes it easier for employees to track their compensation and for employers to maintain accurate records for income verification purposes.

Digital pay stubs are provided electronically, usually via email or a secure payroll platform. They're convenient, eco-friendly, and accessible from anywhere. Printed pay stubs, on the other hand, are the traditional paper versions often attached to a physical paycheck. Both are valid, but digital versions are becoming the norm for modern payroll systems.

Yes, pay stubs are commonly used for income verification. Whether you're applying for a loan, renting an apartment, or providing employment proof, recent pay stubs showing gross pay, net pay, and YTD totals serve as credible financial documentation.

Small businesses can save time and reduce errors by using pay stub software. These tools generate accurate earnings statements, handle direct deposit records, and provide both digital and printable formats. For businesses looking to streamline payroll while staying compliant, pay stub software is a practical investment.

Sign up for our first free pay stub version. Enter your details below: